Banking on Banks 2024: Credit and Debt infographic

ABSTRACT OF BANKING ON BANKS 2024: CREDIT AND DEBT

Since 2022, as part of our Banking on Banks series, we have been surveying consumers across Europe about managing their finances, and the role of financial providers in helping them do so.

Throughout the series we have provided financial institutions with a clear image of consumer perceptions, particularly as they were consumed by the cost-of-living crisis, wrestling with spiraling inflation and rising prices.

This year the cost-of-living crisis is still not over. In fact, an Ipsos Mori poll earlier this year showed that just 24% in the UK expect the economy to improve in the next 12 months.

However, we have seen cause to be a bit more optimistic than last year. In May, the Governor of the Bank of England Andrew Bailey said that the economy had turned a corner, while the International Monetary Fund (IMF) announced that the UK is set for a “soft landing” as the economy has grown faster than previously expected following the recession last year.

In Europe and the USA, there’s been cause for optimism too. At the start of the year consumers reported feeling slightly more optimistic than they did in the previous quarter. And Americans reported being even more so than their European counterparts.

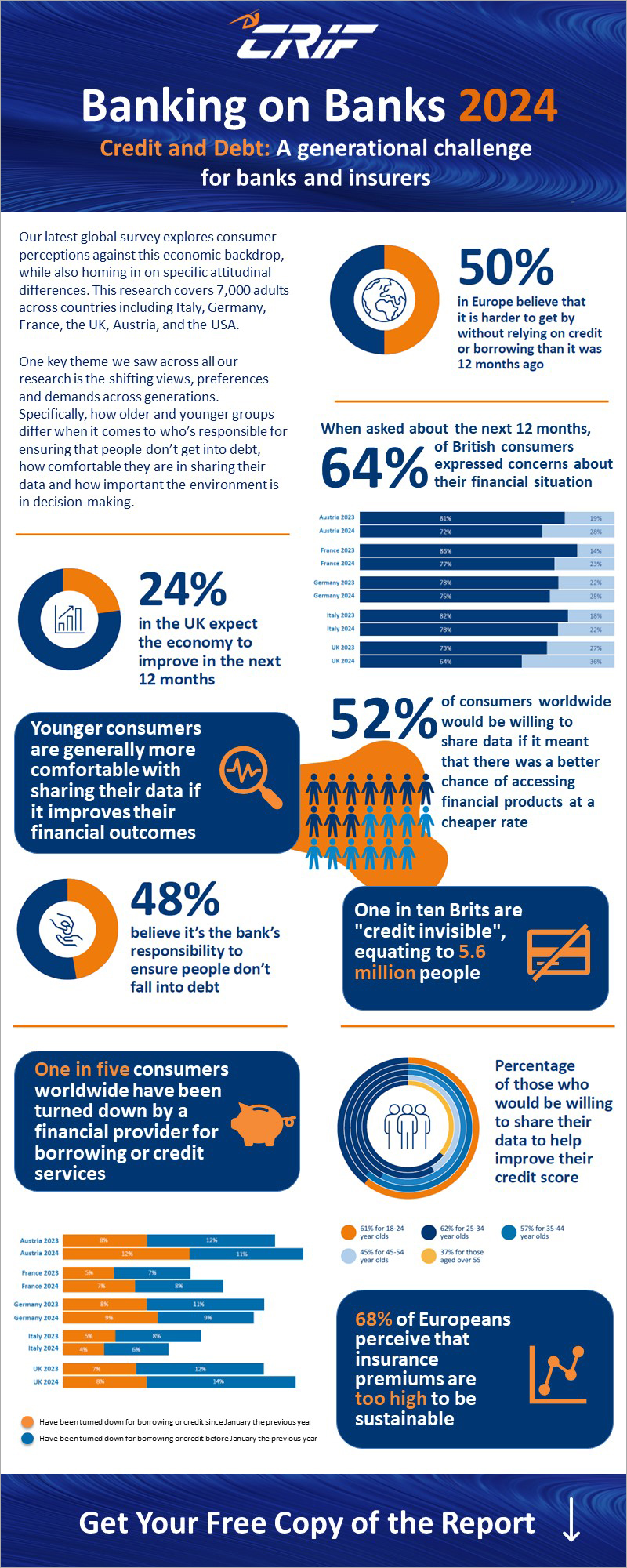

Our latest research explores consumer perceptions against this economic backdrop, while also homing in on specific attitudinal differences.

One key theme we saw across all our research is the shifting views, preferences and demands across generations. Specifically, how older and younger groups differ when it comes to who’s responsible for ensuring that people don’t get into debt, how comfortable they are in sharing their data, how important the environment is in decision-making, and their preference for digital experiences over in-person experiences.

These shifting differences present a challenge for banks and insurance companies: meeting the needs of the new generation of customers, while ensuring that services remain accessible for older consumers too. But in this changing environment, it is crucial for organizations to remain agile and responsive.

By leveraging our insights, banks and insurance companies can better meet the ever-changing diverse demands of their customer base, ensuring they provide relevant, high-quality services that foster trust and satisfaction not just across generations, but borders too.