Banking on Banks 2024: The Customer Experience

The digital age has profoundly transformed all aspects of our lives. Now more than ever, convenience, speed, and personalization are paramount in the services we receive, and in many sectors it has become a key battleground for attracting and retaining customers.

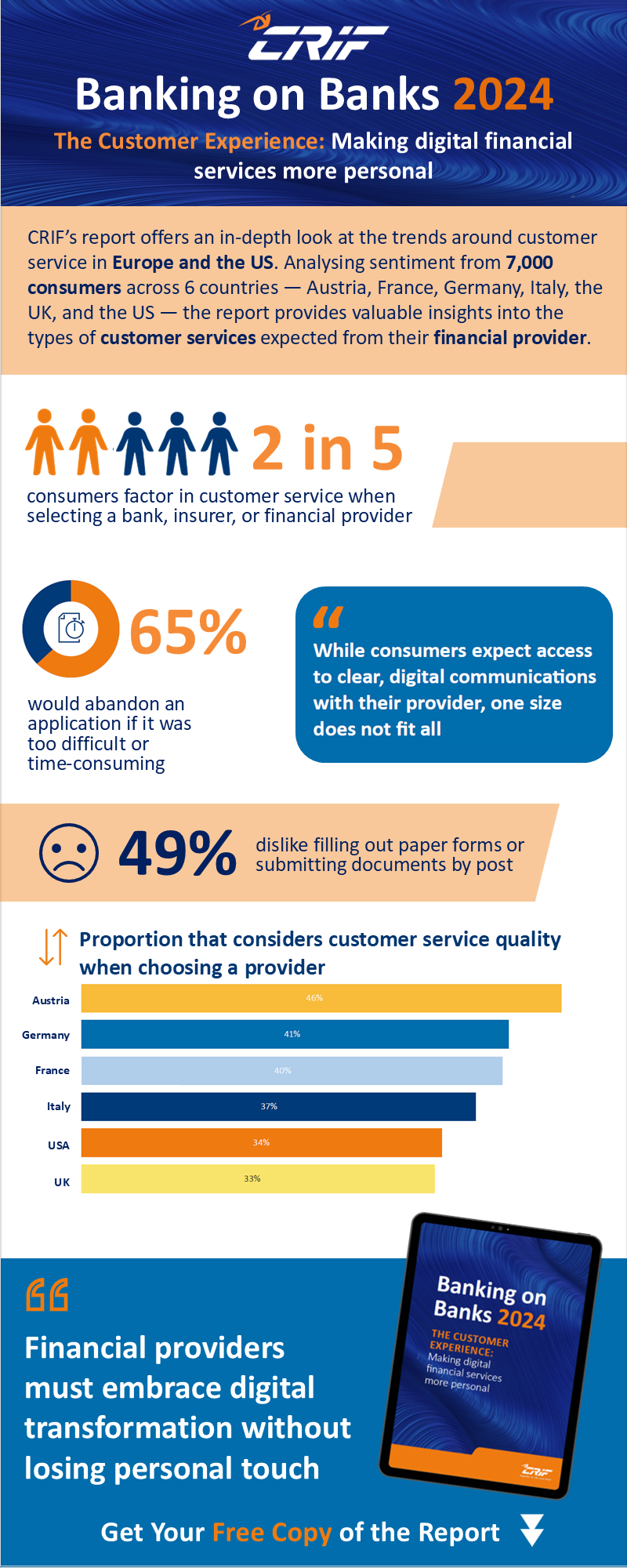

This is particularly true in the financial sector, where customer service quality is an essential competitive factor. But many financial providers are feeling the increasing pressure to adapt to these new digital-first expectations while simultaneously maintaining more traditional and human-centered support.

Our latest report, part of CRIF’s 2024 Banking on Banks series, provides an in-depth exploration of these trends across Europe and the US, revealing vital insights into what today’s customers expect from a more personalized experience. These exact expectations vary by region and age group, underscoring the complexity of now serving a broad demographic that includes both tech-savvy consumers and those who still value in-person interactions.

To remain competitive, financial providers must embrace digital transformation without losing the personal touch. Those who can provide fast, efficient digital experiences while retaining skilled, accessible staff for in-person support will put themselves in the best position for success. This balance is critical, as consumers increasingly expect near-instant decisions for products and services like loans or credit but want to retain the ability to speak to real people when making major financial decisions.

Meeting these demands requires robust, agile systems capable of quickly assessing eligibility with minimal customer input.

CRIF’s digital transformation solutions are helping providers offer the full digital customer journey by increasing customer conversion rates and reducing operational costs by 35%. We also utilize over 200 different KPIs, indicators and scores in credit assessments, identity verification, fraud checks, cashflow and affordability, helping providers to meet the demand for fast, accessible, and convenient decision-making on products and services.

Financial providers that take a multifaceted approach to customer services, addressing both digital and personal preferences, can better distinguish themselves from the competition in this evolving landscape. By leveraging the right partnerships, these providers can establish a fully integrated digital customer experience while maintaining high standards of human support when needed.