Decision Engine for Collection

DECISION ENGINE FOR COLLECTION & RECOVERY

CRIF offers an advanced collection management decisioning solution, enabling organizations to manage all decision-making touchpoints of the end-to-end collection process.

From portfolio data enrichment to segmentation through advanced collection scoring models and optimal strategy design, we help our clients improve their performance.

KEY AIMS OF COLLECTION STRATEGY

- INCREASE RECOVERY RATE: AI-driven process leading to higher recovery rate

- OPTIMIZE RECOVERY COSTS: Reduction of OPEX costs relating to recovered amount, improving process efficiency

- ROLL RATE IMPROVEMENT: Reduce the Roll Rate for fewer cases “rolling” into default

- FTE EFFICIENCIES: Increased process automation, reduced involvement of collection officers in the process, reduced rework rate

- CONSTANT POLICY REVIEW: Constant review of policies, staff allocation, processes, budget execution, etc.

- TAILORED APPROACH: Consumers expect a personalized approach but potentially with less human interaction.

DECISION ENGINE USE CASES ACROSS THE COLLECTION PROCESS

- Early collection strategy

- Score (collection) / Self-cure models

- Contact strategies

- Collection amount estimation

- Management of collection agencies/insourcing

- Restructuring & Settlement (late stage)

- Recovery allocation strategies (Work/Place/Sell)

OUR COLLECTION KPIs

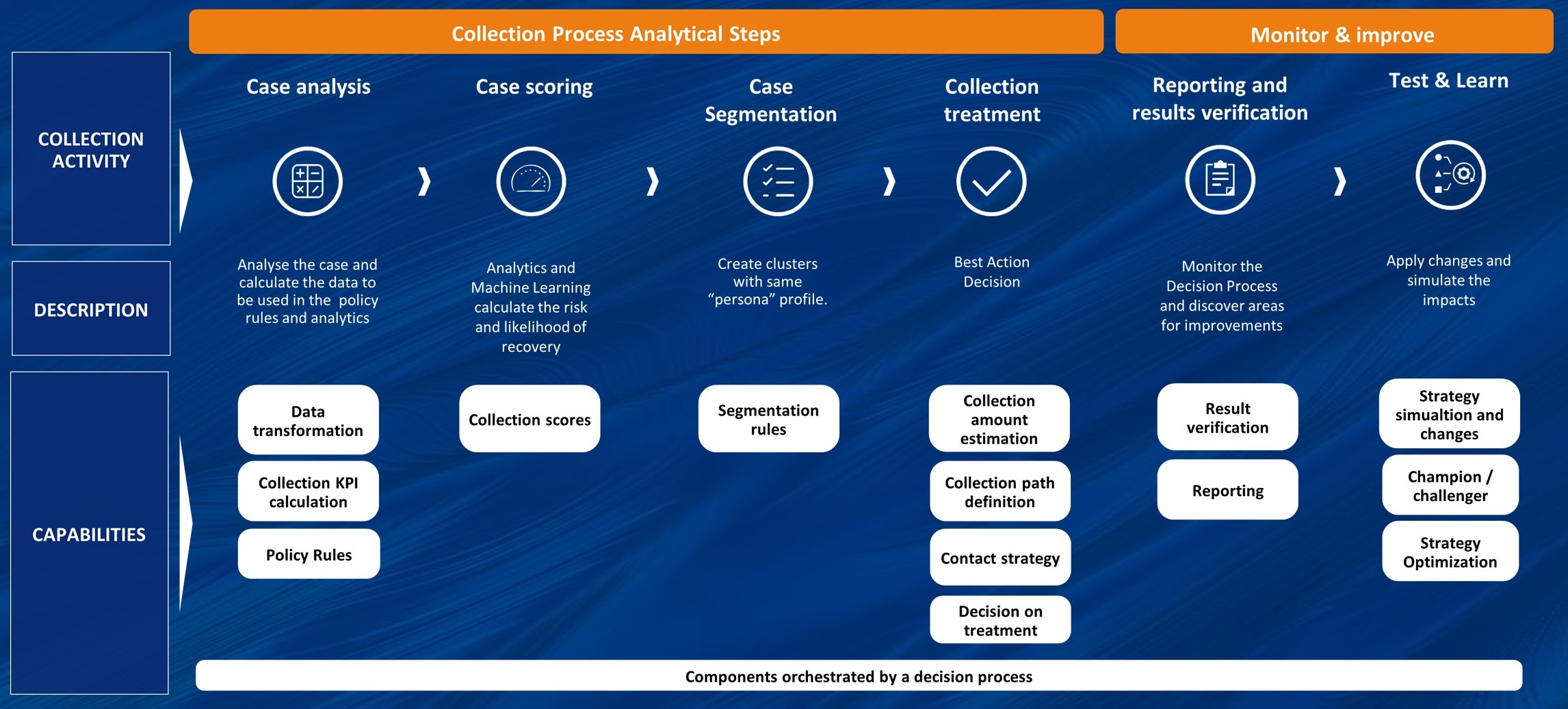

COLLECTION DECISION ENGINE CAPABILITIES

ANALYTICS & MACHINE LEARNING

Ability to leverage advanced analytics to obtain granular portfolio segmentation and create clusters with the same “persona” profile. Granular segmentation can guide the timing and type of collection action.

CONFIGURABLE DECISION PROCESS

Ability to make consistent decisions by leveraging both analytics and the control of subject matter experts over decision-making logics thanks to our no code designer.

MONITOR & IMPROVE

Ability to monitor the performance of decision-making processes using a dashboard in order to discover improvement needs, apply any changes and carry out what-if scenario analysis to understand the impacts.

Testing in production using a champion/challenger approach

HOW DOES DECISION ENGINE FOR COLLECTION WORK?

In the initial step, the decision engine is fed with data, which can come from multiple data sources including: internal data or external data sources such as credit bureau, business information, open banking, etc.

The decision engine performs data transformation and the calculation of policy rules and KPIs, further enriching the target data model.

In order to improve performance, once you have a complete dataset, our segmentation and scoring models allow the collection strategy to be identified, directing each segment toward the optimal course of action.

The collection strategy and score are determined at the outset of the process and periodically refreshed in order to adjust the customer assessment based on the customer’s behavior and responsiveness to the actions applied.

The collection score can be evaluated at a product type level; if one customer has more than one delinquent account, a customer level score can also be calculated, either through an additional dedicated scorecard or as the result of aggregation rules applied to the product scores.

CRIF’s decision engine allows collection cases to be segmented from different perspectives, capturing and summarizing all the relevant characteristics and ensuring the comprehensive profiling of all delinquent customers.

After the accounts and debtors are scored and segmented, the decision engine helps users automate the collection decision by calculating a repayment plan with settlement option.

In the following step, the contact strategy is executed, with recommendation of the optimal communication channel, always with a focus on the client/debtor as well as other conditions such as customer responsiveness, contact channel preference or other factors that can flexibly designed or modified by the business user.

CRIF’s decision engine supports customer-centric process management, integrating data coming from multiple data sources, calculating aggregated metrics at a counterparty level and making them available for decision automation as well as manual review.

The solution also includes a Business Intelligence & Reporting module, which enables the monitoring of collection performance.

The Strategy Optimizer identifies any necessary modifications to apply to the strategy in order to continuously improve performance, with the following benefits:

- Provides powerful insights and visibility of the collection strategy effectiveness as well as performance of the collection process, including the individual performance of collection employees

- Provides the option to integrate collection strategy data with external data (e.g., outcome of recovery actions)

- Users can define KPIs, with the option to receive trigger alerts in the case of special events

- Continues improvement of collection strategies thanks to test & learn functions such as Champion Challenger or Strategy Simulation (leveraging powerful what-if simulations)

Solving complex challenges with AI optimization

CRIF’s decision engine decision optimization module is an AI-driven solution, which helps solve, through mathematical optimization, complex challenges such as:

- “Do we have right number of personnel dealing with collection cases?”

- “If I had 10% more capacity, what would the financial impact be?”

- “If we reduce our workforce by 5% or 10%, how will this affect our results and which adjusted strategy would maximize the collection goal under these new constraints?”

- If you’re halfway through the month and you haven’t hit your targets — “How can we optimize our strategy to refocus?”

Intuitive graphics and easy implementation

The full collection strategy is available to expert and non-IT users at any time through the graphical user interface. CRIF’s decision engine designer is a self-service interface that enables the graphical authoring, design, testing, simulation, deployment, running and administration of decision strategies.

For example, scoring and strategies can be designed (and modified over time) by business users autonomously without IT intervention. Users can independently configure segmentation rules by leveraging a wide range of data pertaining to the delinquent customer profile, to its past due amount or to its current and past repayment performance through an intuitive graphical interface.

Full change management and audit tracking

The decision engine provides users with full audit tracking thanks to audit logs and versioning of all changes. The solution creates automatic documentation and is capable of comparing various process versions and highlighting differences.

A peer review allows the evaluation of the decision process configuration by one or more people (4 eyes check, 6 eyes check…etc.) as a precondition to deployment. Each reviewer must approve the work done to enable deployment of the decision process.

The figure below shows an indicative example of how the decision engine can support a standard collection process from end to end (not in relation to the application of the CRIF decision engine in the collection process).

NEEDS

- Constant pressure to increase the recovery rate

- Further optimization of process-related costs (OPEX and FTE efficiencies)

- Tailored approach and handling of each case, reducing human interaction if possible

- Data-driven decisioning with the option to apply advanced AI optimizations.

- Constant policy review and execution monitoring

The CRIF decision engine can support collection and recovery at multiple stages of the process, including:

- Early collection strategies

- Collection scores, including self-cure models

- Contact strategy optimization

- Management of various collection channels including collection agencies

- Allocation strategies for late-stage recovery

BENEFITS

For financial companies

-

- Lower NPL ratio

- Higher recovery rates

- Lower risk costs

- Lower operating costs

- Shorter time to recovery

- Lower provisions

For consumers / debtors

-

- Personalized approach

- Reduced collection fees

- Early collection reminders

HOW WE HELPED OUR CLIENTS UNLOCK THEIR POTENTIAL

Discover how some of the world's most important companies improved their performance and defined a brand-new digital path, both for them and for their clients.

UNIFIED COLLECTION SYSTEM INTEGRATED WITH EXTERNAL SYSTEMS

The client needed to create a unified collection system that could integrate with external systems

- Unified Collection System

- End-to-end management of origination and monitoring processes

-

1 Million

Contracts processed Daily

-

1000

Users simultaneously working on the system

-

6000

Calls processed simultaneously

ENHANCING ORIGINATION AND COLLECTION MANAGEMENT

The client needed to improve the risk evaluation while reducing rollover of customers into collection and optimize early stages collection strategies

- Credit Scorecards

- Strategies fo credit limit management and early stage collection

-

+30 %

Increase in on-time payments

-

22 %

Decrease in 30-day past due accounts and balance roll rates

-

+6 %

Increase in collection revenue (of 45-day collection portfolio)

IMPLEMENT A UNIQUE COLLECTION SYSTEM

The client needed to implement a unique collection system while reducing time to decision and decreasing operational overtime

- Decision Engine to speed up time to market

- Decision Engine to support Collection process

-

-46 days

Reduction of time to recovery (default clients)

-

+15 %

Collection performance

-

-20 %

FTE

GET IN TOUCH WITH THE SALES TEAM

What does the next digital journey of your business look like? Let's find out together.