BANKING ON BANKS 2024: THE CUSTOMER EXPERIENCE

Executive summary of Banking on Banks 2024: The Customer Experience

MAKING DIGITAL FINANCIAL SERVICES MORE PERSONAL

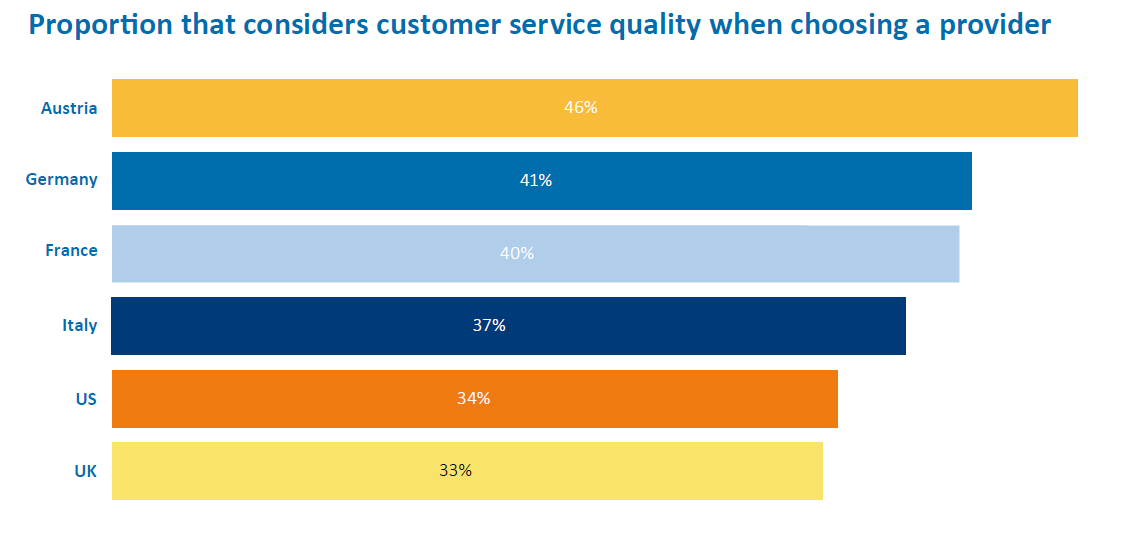

Customer service quality has become a critical factor in consumer decision-making, especially in the financial sector.

Consumers want faster, more convenient, and highly personalized experiences, leaving traditional banks under increasing pressure to keep up with changing customer expectations.

A high-quality customer experience is now indispensable for traditional banks aiming to stay competitive in this evolving market, as reported by EY. This shift is evident across all demographics, with consumers expecting better and more tailored support.

However, with fintechs and other digital-first providers setting new standards in these areas, traditional banks are increasingly being challenged to offer a higher quality of service and multi-channel communications to retain the trust and loyalty of their customer base.

The latest report from CRIF offers an in-depth look at the trends around customer service across Europe and the US. Analyzing sentiment from 7,000 consumers across six countries — Austria, France, Germany, Italy, the UK, and the US — the report provides valuable insights into the types of customer services expected from their financial provider.

Notably, the research reveals distinct preferences across age groups and regions, outlining the key challenges facing financial providers, as they balance increasingly diverse customer needs.

This includes meeting the needs of younger customers that may prioritize digital solutions, while balancing traditional in-person services that are preferred by older groups, requiring financial providers to understand the differences that exist between ages and markets, especially where more developed digital financial services exist.

Moreover, the immediate services available in other parts of consumers’ lives – such as food delivery and shopping – have raised expectations for near-immediate decisions around products and services for many.

When customer services fall short, consumers are willing to abandon their applications and potentially choose another provider.

To effectively compete, more traditional banks, insurers and financial providers must refine their approach by embracing digital transformation without sacrificing the human support that differentiates them from newer market players.

In an era of heightened consumer expectations, banks and insurers that succeed in delivering both efficient digital experiences and reliable, human-centered support are more likely to retain their customers and stand out from competition.

Adopting a flexible and tailored approach to customer services can enable financial providers to address the challenges posed by a diverse, evolving customer base and foster lasting loyalty.