BANKING ON BANKS 2024: DATA AND TRUST

Executive summary of Banking on Banks 2024: Data and Trust

MOVING FORWARD RESPONSIBILITY

In 2024, we are taking a closer look at how priorities are shifting for consumers when it comes to their relationship with their banks and insurers, as they start to emerge from the worst of the rising cost of living.

This year, for the first time, we have moved beyond Europe to include the US in our research so that we can view the picture through a wider global lens. The US has been included in this year’s survey while Spain, which we surveyed in 2023, is omitted. Our research now covers 7,000 nationally representative adults across six major economies: Austria, France, Germany, Italy, the UK, and the US.

We are highlighting these findings in a series of four Banking on Banks reports throughout the year. The first report explored consumers’ relationship with credit and debt, examining the economic backdrop that they are facing, and which products and services are needed.

In the second report in our series, we are looking at the challenges and opportunities for banks, insurers, and other financial institutions when it comes to data sharing and trust. The aim is for these reports to include actionable insights that providers can use to help them meet the raised consumer expectations and demands they are facing today.

When people are asked specifically about what they want from their providers, it’s clear they want fast, accurate decisions on products that meet their specific needs, and to be protected from fraud. These are exactly the types of benefits that open banking, data enrichment and other developments in advanced analytics can provide, but many consumers remain wary.

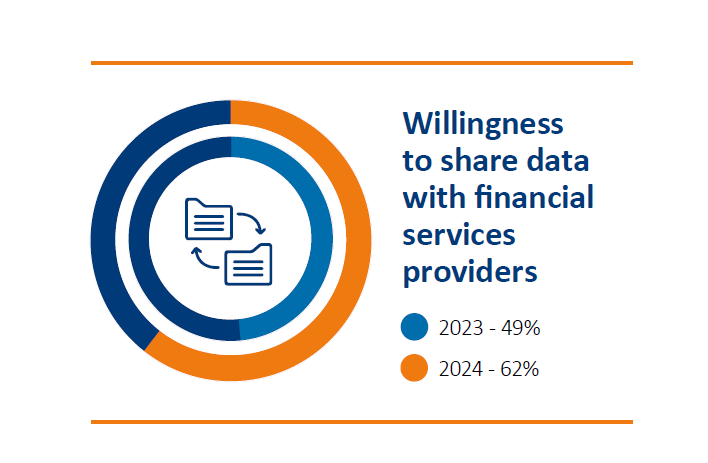

This poses a double challenge for banks, insurers, and other financial providers. On one hand, they must adopt the latest innovations to improve processes and decode customer behaviors and trends in real time in order to meet modern consumer needs. But on the other hand, skepticism about sharing financial information could hinder the success of these efforts.

Ultimately, providers need to do more to communicate the benefits on offer through sharing more financial data, and how this can help consumers to access the personalized support they really need, especially in these challenging times.

In short, banks and other providers need to go that extra mile to build trust with consumers.